charitable gift annuity administration

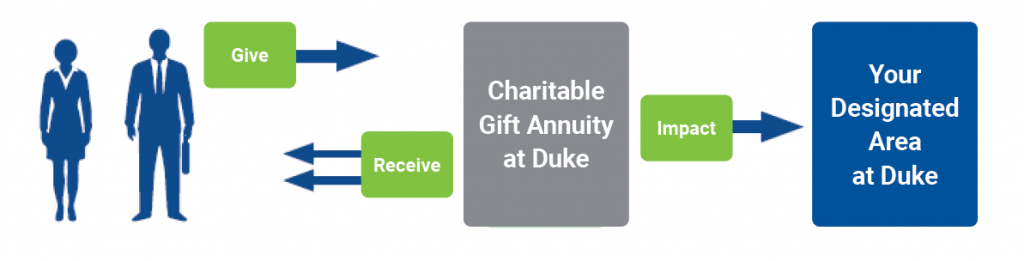

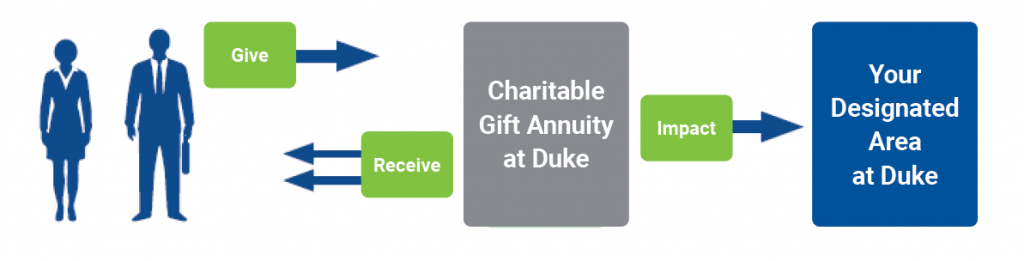

Offering constructive expert administration services to assist you and your donors in managing your philanthropic endeavors. A charitable gift annuity is an agreement formalized as a contract between the donor and a charitable organization that establishes and maintains the annuity.

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

A charitable gift annuity CGA is a simple agreement between an individual and a non-profit organization.

. This type of life income fund can be established with a gift of 10000 or more to Delgado Community College through the Delgado Community College Foundation. Learn some startling facts. Established in 1995 Charitable Trust Administration Company CTAC has provided administration for planned giving vehicles for over 20 years.

Ad Annuities are often complex retirement investment products. Take a Closer Look at the Main Types of Annuities Common FAQs. Best to be prepared and ready to assist your donors with this innovative plan.

2022 and voted to increase the rate of return assumption we use when suggesting maximum payout rates for charitable gift annuities. Payout rates for two persons and for deferred gift annuities are available from the Office of Institutional Advancement by calling 504 671-5412. The financial office asks for a FASB liability report once a year at a few NFPs once a quarter.

Activities are geared towards bringing in new planned gifts ongoing administration and donor stewardship. Charitable Solutions LLC is a planned giving risk management consulting firm. A charitable gift annuity allows you to support charitable causes you care about and receive consistent income.

We currently administer over 150 charitable remainder trusts and 600 charitable gift annuity contracts. 125 rows Annual expenses for investment and administration are assumed to be 10 of the fair market value of gift annuity reserves. Often times we want to donate but are worried about running out of money in retirement.

WatersEdge giving professionals are ready to help you create a CGA today. It can be for one or two people. Based on their ages they will receive a payment rate of 39 which means that they will receive 780 each.

Ad Curious About Annuities. GiftLaw343 Testamentary Gift Annuity 2 Bawden Elizabeth. We focus on non-cash asset receipt and disposition charitable gift annuity risk management gift annuity reinsurance brokerage services and life insurance appraisals.

A gift annuity the simplest life-income agreement is a contract between Cornell and a donor that is established with a gift of 10000 or more. Paul Place Suite 2700 Baltimore MD 21202 For questions regarding annual filing requirements contact the Company Licensing Unit by email at the above address or by phone at 410-468-2104. Principal After two lives property to charity.

The American Council on Gift Annuities ACGA Survey of Charitable Gift Annuities is the best source of data there is on gift annuities and gift annuity programs. As one can see a charitable testamentary gift annuity may well be an estate planning tool that we will see more of in the days to come. Charitablegiftmiamarylandgov or in hard copy to.

Charitable Gift Annuity We offer comprehensive affordable gift annuity administration for your charitable organization freeing you to concentrate on other tasks. Meridian St Suite 700 PO. Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

Charitable Gift Annuity Program The University at Albany Foundation offers a charitable gift annuity program for donors interested in life income arrangements and for SUNY colleges and universities who do not manage or administer their own program. For illustrative purposes only. Our team works collaboratively with nonprofits to ensure integrated solutions for prompt and efficient administration of charitable gifts.

2 CREATE YOUR CGA. In exchange for a gift of assets ie cash stock bonds real estate etc the donor s receive a lifetime income. Cash or Property Annuity payout for one or two lives.

Its called a Charitable Gift Annuity. Gift annuity rates are the same for males and females whereas rates for annuities offered by insurance companies are gender-based. Maryland Insurance Administration Company Licensing Unit 200 St.

Please consider participating in this enormously valuable survey. Donors often use Charitable Gift Annuity payments to support themselves spouses or other. We also provide emergency assistance fund administration.

Charitable Gift Annuity Administration 2 Broad Overview State Regulation Asset Management Keeping up with Annuitants Charitable Gift Annuity Administration 3 The Basic CGA Bypass gain on appreciated property. The return assumption will be moving to 45 from 375 effective July 1st of 2022. 1 CONNECT WITH US Virtually by phone or in-person our giving experts are ready to serve you.

Use this Guide to Learn Which Annuity Product Fits Best with Your Financial Goals. We assist in determining an organizations. We efficiently and effectively administer complex philanthropic programs including.

Bryan Clontz is the founder and president of Charitable Solutions LLC specializing in non-cash asset receipt and liquidation gift annuity reinsurance brokerage actuarial gift annuity risk management consulting emergency assistance funds as well as virtual currency and life insurance appraisalsaudits. In exchange for a gift of assets ie cash stock bonds real estate etc the donor. Charitable Gift Administration Customized to Your Needs As gift administrators we provide personalized support to our client charities and their donors.

For gift planning offices at most not-for-profit organizations NFPs FASB accounting is the last thing on the list. Right now the ACGA is conducting its latest nationwide survey of charitable gift annuity programs and you can help. In exchange for this generous gift the donor will receive guaranteed payments at stated intervals for life.

At death the non-profit organization retains the use of any unused principal and interest. The Foundation approves the establishment of each gift annuity on a case-by-case basis and is not obligated to accept all. When used effectively consulting services can save a charity both time and money.

Financial Services Regulatory Authority of Ontario. A gift annuity is an amazing way to give a gift to Doane as well as provide income for the rest of your life.

Charitable Gift Annuities Giving To Duke

Charitable Gift Annuities Giving To Duke

Charitable Gift Annuities University Of Montana Foundation University Of Montana

Charitable Gift Annuities Kqed

Charitable Gift Annuities Friends University

A Way To Gift To The Charities I Love To Support Wels

4 Long Term Ways To Give To Charity Capstone Financial Advisors

Change Of Address Checklist Real Estate Seller And Buyer Etsy Change Of Address Checklist Listing Presentation

Charitable Gift Annuity How It Benefits Others And You

Is It Worth Starting A Charitable Gift Annuity Program Cck Bequest

Cga Program Best Practices You Need To Know A Review Of The Acga Cgp Cga Survey

City Of Hope Planned Giving Annuity

Charitable Gift Annuity Pros And Cons Blog Jenkins Fenstermaker Pllc

Charitable Gift Annuities Uses Selling Regulations

Charitable Gift Annuities Uses Selling Regulations

4 Long Term Ways To Give To Charity Capstone Financial Advisors

Charitable Gift Annuities The Community Foundation For Greater New Haven